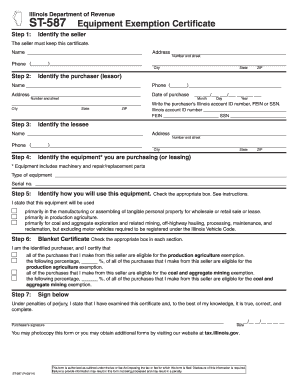

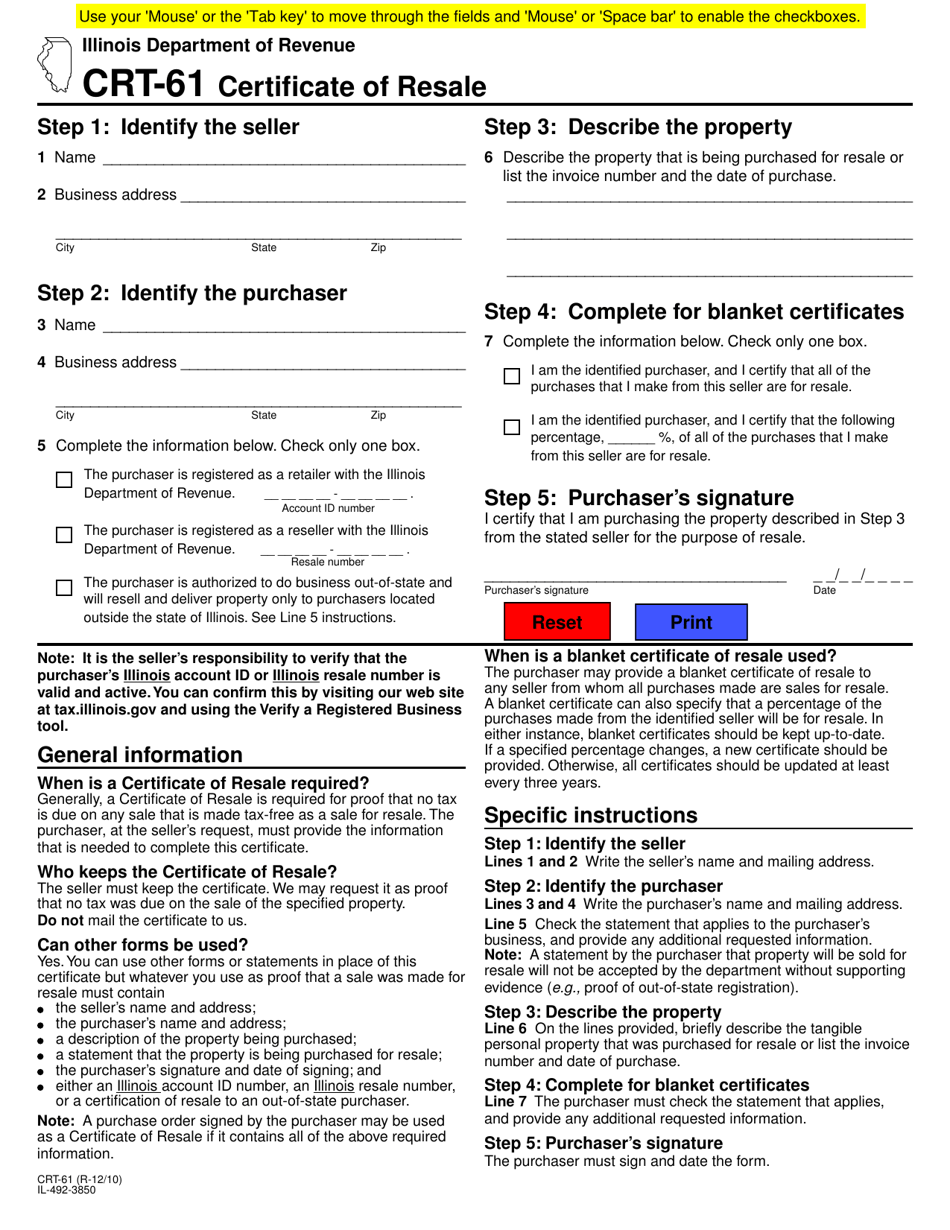

Applying for 501(c)(3) status for your nonprofitĪfter you have created your nonprofit, the steps below will help you apply for tax-exempt status. This could lead to losing your status and paying fines to the IRS. Note: Net earnings of a 501(c)(3) cannot go to a person. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You must apply for both additional exemptions separately.ĭonations to certain nonprofit organizations are also tax deductible for the person making the donation. Taxes on money received from an unrelated business activity.Ī 501(c)(3) operating in Illinois may not have to pay Illinois sales tax and it may exempt from real estate taxes on property it owns.īoth the Illinois sales tax and property tax exemptions are not automatic based on the 501(c)(3)'s income tax-exempt status.Employment taxes on wages paid to employees, and.Nonprofits and taxesĥ01(c)(3)s do not have to pay federal and state income tax. Include the nonprofit’s EIN in case the donor wants to check the charity’s tax-exempt status. The acknowledgment to the donor should include the following: Tax-exempt status statement: Statement that the organization is a 501c3 tax-exempt organization.

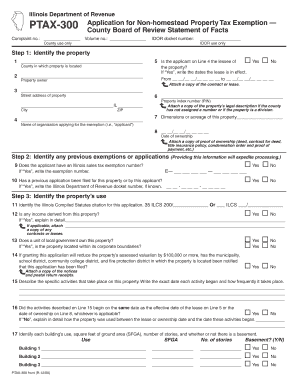

This article does not address the on-going reporting requirements for tax-exempt organization, or registering your entity with the Illinois Attorney General's office. The donor will use this letter as proof of his or her donation to claim a tax deduction. PTAX-300 Non-homestead Property Tax Exemption.pdf PDF icon. This includes income, sales and real estate taxes. Declaration of Intent to be a Write-In Candidate - SBE Form P-1F. name submitted per form UCC-11 Information Request for Federal Tax Lien. In this article, we will focus on applying for tax-exempt status for 501(c)(3) organizations in Illinois. You may purchase and immediately print a Certificate of Good Standing for a.

0 kommentar(er)

0 kommentar(er)